MULTIFACETED RISKS FACING FINANCIAL SERVICES

Despite the considerable progress made by the industry since the

global financial crisis, the next three years pose an ominous challenge.

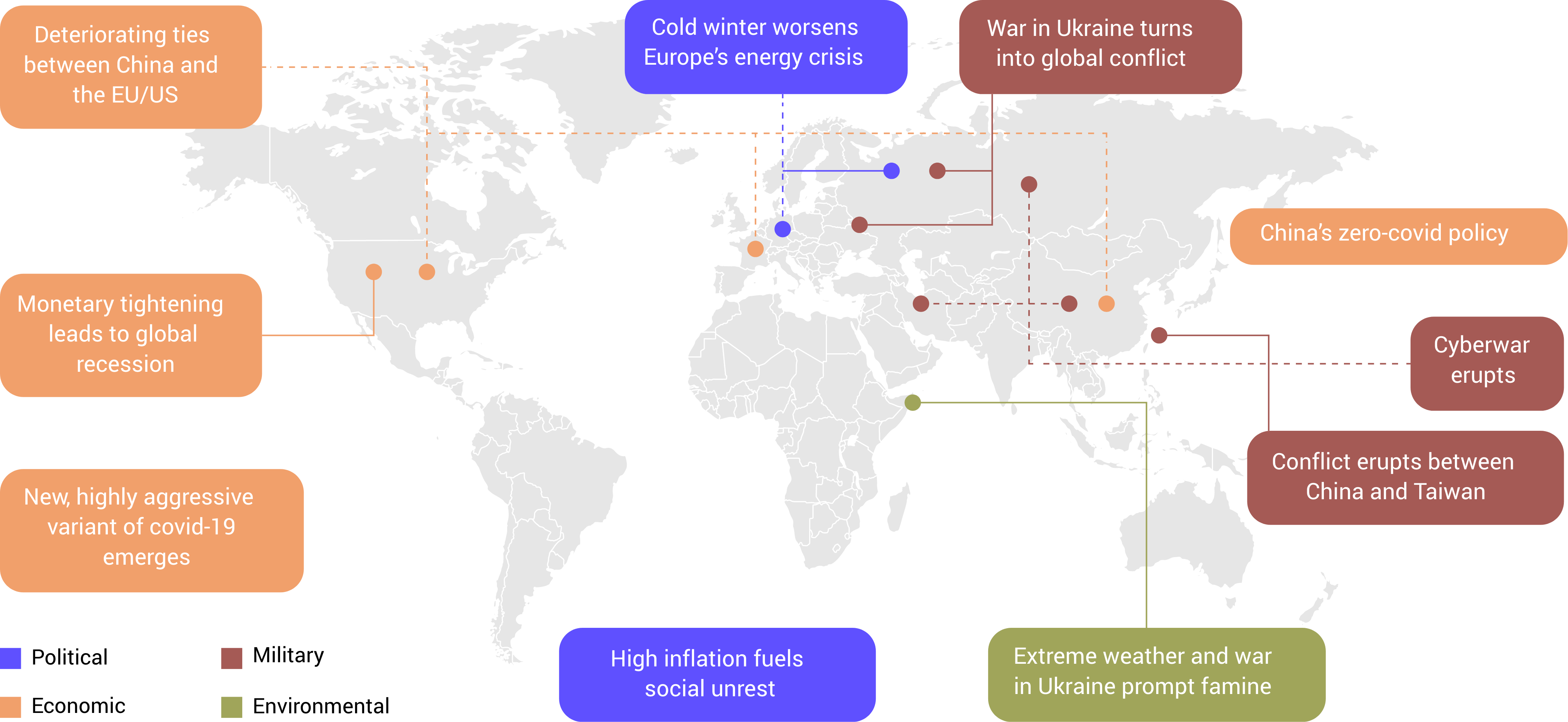

As we look back on the tumultuous year of 2022, marked by a sweeping

pandemic, geopolitical unrest in Ukraine, supply chain disruptions,

and rising commodity costs, we must also acknowledge the unprecedented

start to 2023. So far, we have witnessed the collapse of Silicon Valley

Bank, which operated for eight months without an official CRO,

the takeover of Credit Suisse, which led to massive ATI write-offs,

yet again a reminder at how interconnected the financial services

industry truly is.

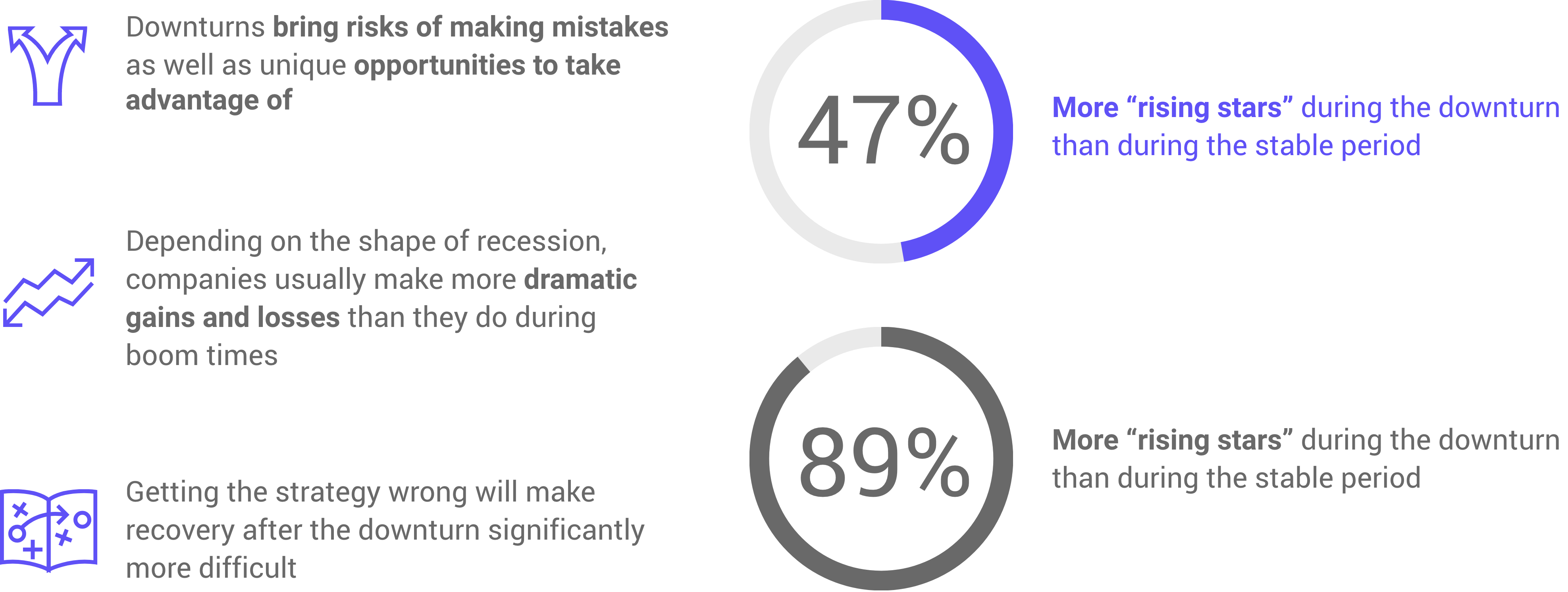

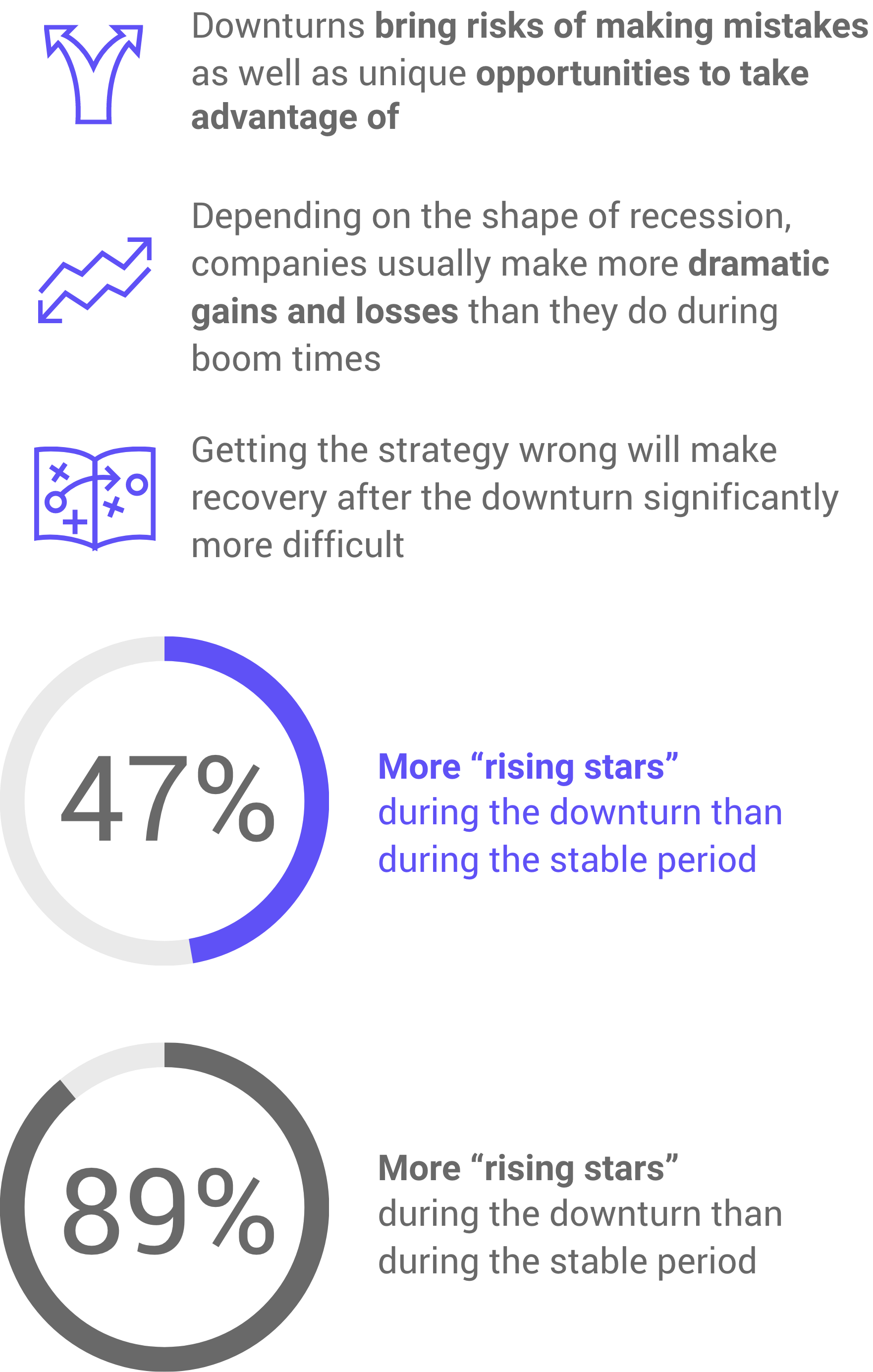

The role of Risk and Control leaders has expanded and grown

increasingly complex, with risks that intersect and amplify

each other in unpredictable ways. The ability of risk leaders

to develop and execute highly effective response strategies will

be a crucial determinant of success. The challenges that Risk,

Regulation, and Control leaders faced in the past still persist,

but the landscape in which they operate has grown increasingly

intricate and multifaceted, with pressures that extend well beyond

the boundaries of financial services.

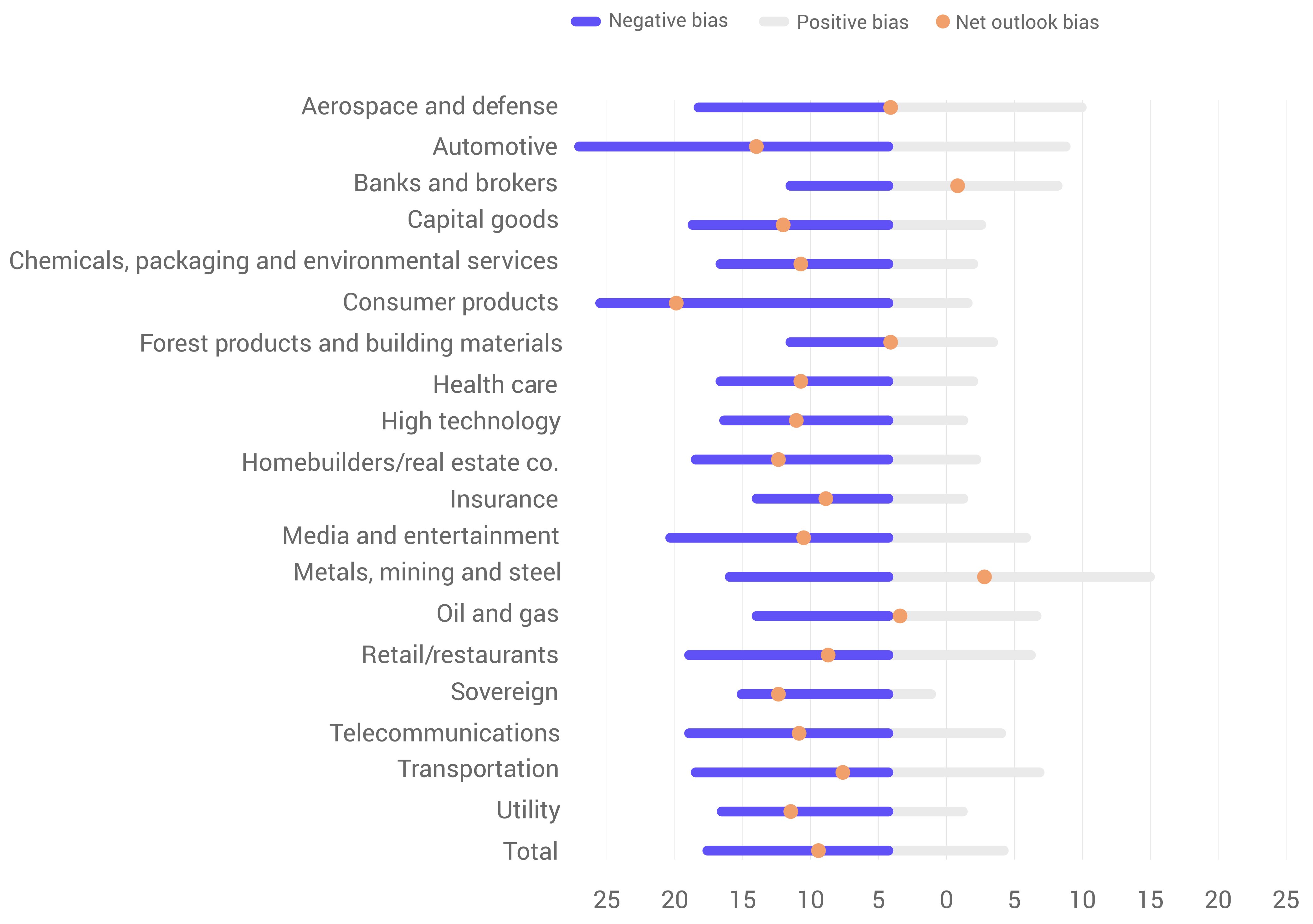

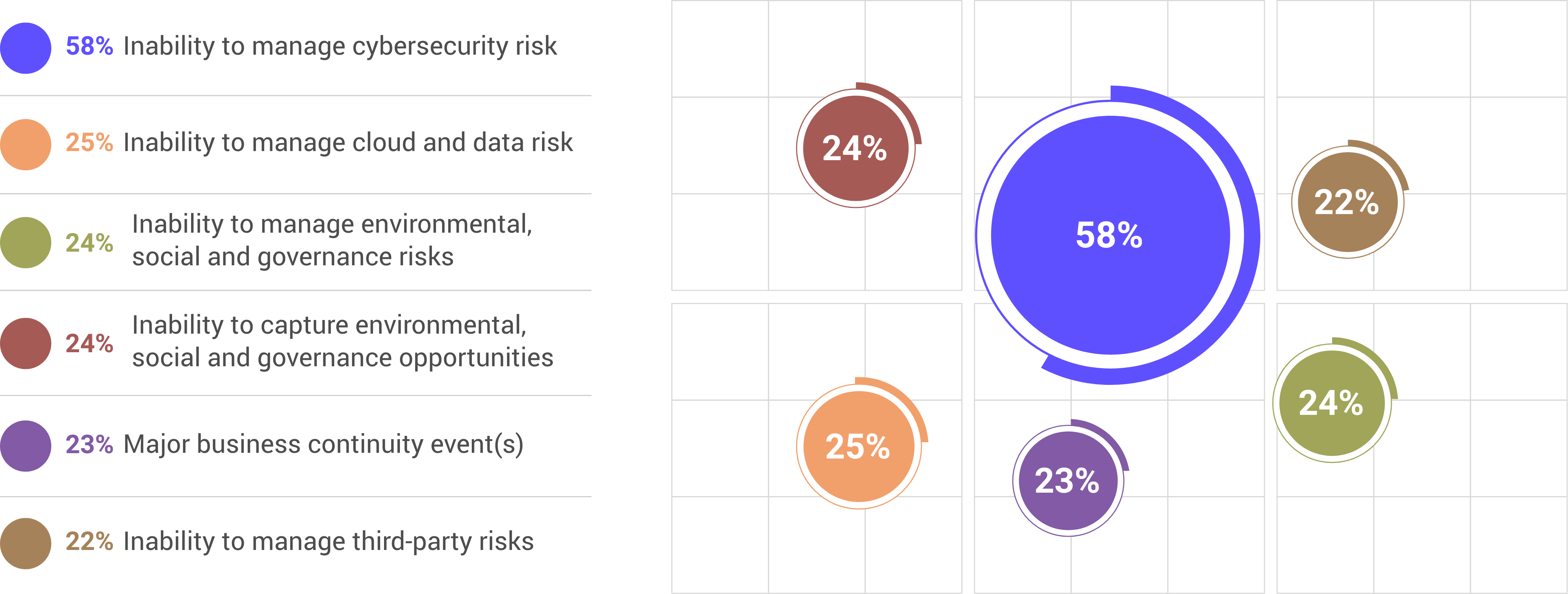

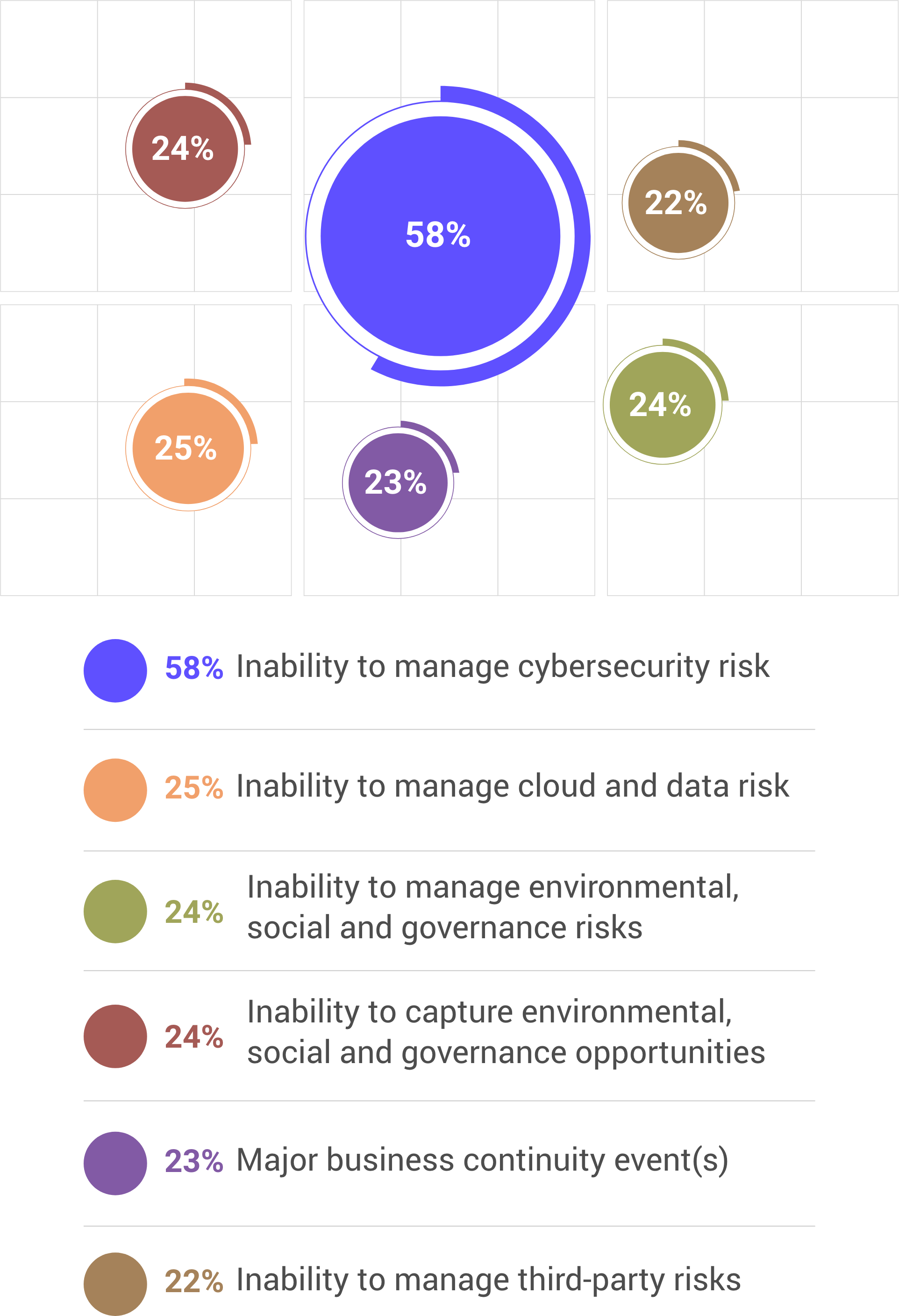

The chart below highlights 'Top Risk priorities for the next 12 months'

with the length of each bar representing the percentage of respondents

that chose each priority. Respondents were asked to pick their top five

risks.

Top 7 CRO risk priorities for the next 12 months

-

Cybersecurity risk72%

-

Credit risk59%

-

Environmental risk

(e.g, climate, biodiversity)36% -

Implementation of regulatory

rules and supervisory

expectations34% -

Operational resilience34%

-

Transition to digital

strategy and processes28% -

Geopolitical risk28%

[Chart from EY/IFFs CRO survey, conducted in the 2H of 2022

consisting globally of 88 financial institutions across 30 countries,

of which 14% of which were G-SIB organisations.]

Read Less

Read More